Why Invest in the Stock Market?

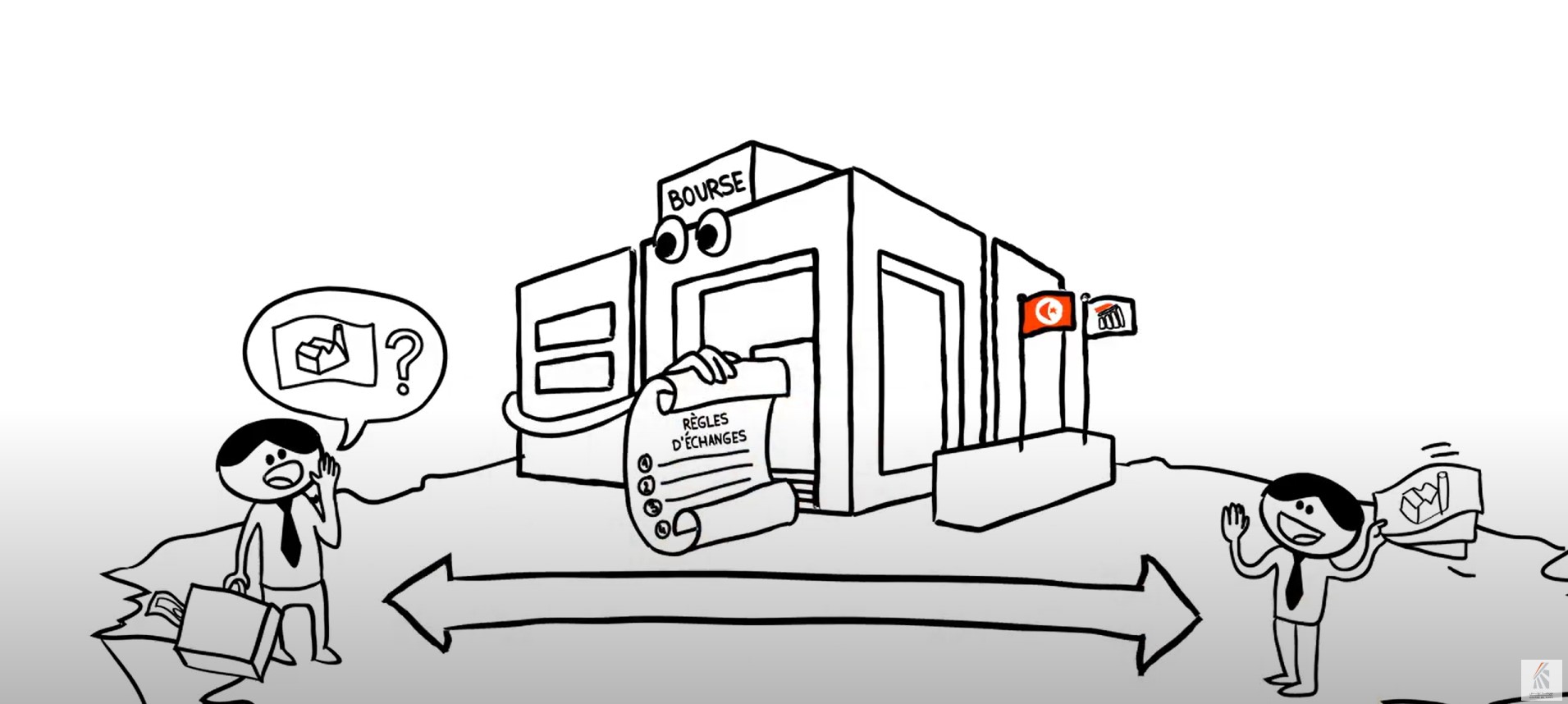

As a flagship financial institution, the Stock Exchange is often perceived by the wider public as a tool reserved for sophisticated investors with significant capital.

This perception, once justified, is no longer valid. Today, the Stock Exchange is accessible to everyone, each according to their means, offering attractive opportunities to grow their savings.

Market professionals, in particular brokerage firms, are available to guide new investors. As for the Financial Market Council, whose primary mission is to safeguard savings invested in securities, it ensures that all market participants comply with the applicable legislation.

Equity investments can serve as a savings solution for those seeking long-term investments, for example to prepare financially for retirement.

By investing in the stock market, savers aim to achieve returns that, over time, may exceed those of other forms of investment.

The advantages offered by the Stock Exchange

Liquid and profitable investments

particularly over the long term

Continuous valuation

of assets

Exemption from capital gains tax, subject to a minimum holding period of securities

Tax relief for holders

of an Equity Savings Account

The status of shareholder and co-owner

in reputable companies

Stock market products

The Tunisian financial market today offers investors a wide range of securities products, each designed to meet specific objectives depending on the level of risk, return, or liquidity sought.

This diversity, combined with the tax incentives granted to certain products, is helping to popularize stock market investment. It provides genuine opportunities for small shareholders as well as major private and institutional investors.

This document provides a list of the securities products available on the Tunis market, along with their respective characteristics.

INVESTOR’S GUIDE

How to buy securities on the Stock Exchange

Stock exchange transactions must be carried out through a licensed Brokerage Firm, against the payment of commissions. You will therefore need to carefully consider the choice of your Broker.

To place a stock market order, the investor may:

|

In this context, there are two forms of portfolio management:

|

What are the brokerage fees?

| Type of Commission | Amount in TND (excl. VAT) |

| Brokerage Commission (Brokerage Firm) | Commercial relationship between the two parties, with a ceiling set by the Exchange |

| Stock Exchange Commission | 0.15% of the transaction volume |

Note : For more details on stock exchange transaction fees, please refer to Learn More.

What Are My Rights as a Shareholder?

Shares grant their holders various types of rights, mainly the following :

- Voting Rights: to vote on resolutions relating to the dividend amount, the appointment of directors, the company’s capital increase, etc.

- Right to Financial Information: access to the company’s accounts and financial documents.

- Right to Profits: in the form of dividend distributions.

- Right to Net Assets: entitlement to the company’s assets in the event of liquidation. The assets remaining after the repayment of the company’s debts constitute the net assets, which are distributed to shareholders in proportion to their shareholding in the company’s capital.

Investing in the Stock Market: Key Points to Remember

Do you want to invest in the stock market but don’t know where to start? Here are a few practical and easy-to-implement tips.

It is very important to set your objectives before investing, as the choice of your investment depends closely on your goals. These will guide you in selecting the financial instrument in which you invest.

The chosen instrument must be aligned with your investment horizon (short, medium, or long term). Before investing, you should ensure that the investment period matches your objectives and that you will not need access to the invested funds during the holding period.

The return potential of a financial investment is always linked to its level of risk. Investing in high-risk instruments (whose value may fluctuate significantly, both upward and downward) requires careful research and consideration before making an investment decision.

It is also important to take into account the taxation of the instruments as well as the fees and commissions that will be charged, as these can have a significant impact on the potential return.

It is always important to ensure that the brokerage firm or asset management company with which you intend to engage is authorized by the Financial Market Council (CMF). This also applies to mutual funds (UCITS) as well as venture capital investment companies (SICARs) that manage funds on behalf of non-professional investors.

Information to Request: The professional must provide, within the framework of the agreement binding you to them, details regarding management or transaction fees. You are also entitled to receive all financial documentation related to your investments (prospectus, internal regulations and statutes of UCITS, or a prospectus in the case of a stock market listing or a financial transaction, etc.).

- Carefully read the contracts offered to you before signing them, particularly the section relating to fee conditions.

- Do not hesitate to contact your financial professional during your investment to ensure it still aligns with your objectives and investor profile.

- Follow the developments of the companies and mutual funds (UCITS) in which you have invested.

- Stay informed about economic and financial news.

- Carefully review the trade confirmations, statements, and management reports sent to you by your financial professional.

- Consult websites such as that of the CMF (www.cmf.tn) et la Bourse de Tunis (www.tunis-stockexchange.com)

Points to Consider When Investing in the Stock Market

| What is the purpose of my investment? | What information should I provide to my financial intermediary, and what information must they provide to me? | Does my investment |

1 Before investing, ask yourself the right questions. | 2 Meet your | 3 Stay vigilant |

The return of a financial | Answer conscientiously the questions asked by your licensed intermediary. Request all documentation. | Stay informed about |