Why list on the stock exchange

Enhance visibility and credibility

Getting listed means going up a category.

Going public is a major milestone that enhances the company’s image and brand, strengthens its credibility, and secures its future and products on both the national and international scale.

Access new sources of financing

The stock exchange provides access to advantageous financing, without the need for collateral and at a lower cost. It also offers a wide range of secondary financing instruments (such as issuing new shares to raise additional capital), enabling companies to accelerate growth while maintaining valuable agility.

Enhance corporate value

Some entrepreneurs go public for wealth management reasons, allowing them to sell part of their stake to plan for succession or pursue other investments. The company’s valuation by the market enables:

- the shareholder to have an instant estimate of their wealth.

- potential new investors to take a stake in the company.

Shareholder tax advantages

- Tax exemption on the proceeds from the sale of shares for existing shareholders.

- Exemption from capital gains tax on the contribution of shares and equity stakes to the parent company or holding company, provided that these companies commit to listing their shares on the stock exchange no later than the end of the second year following the year of the deduction.

Requirements for listing

The main market

The main market consists of the largest Tunisian companies that meet the relevant admission requirements:

- An admission application submitted jointly by the stockbroker and the issuing company;

- Audited financial statements for the last two fiscal years;

- A draft of admission prospectus;

- A financial valuation report;

- Existence of a procedures manual and a management control structure;

- Existence of an internal audit structure, with the statutory auditor’s opinion on the internal control system;

- A five-year business plan with the statutory auditor’s opinion;

- Profitable results for the last two fiscal years, except in the case of capital increase;

- A minimum capital of 3 million dinars;

- Public ownership of the company’s shares distributed among at least 200 shareholders;

- At least 10% of the capital held by the public.

The Alternative Market

he alternative market is reserved for companies seeking admission through a placement for advised investors without a public offering, and subject to simplified admission requirements:

- An admission application submitted jointly by the listing sponsor and the issuing company;

- Audited financial statements for the last two fiscal years;

- A draft of admission prospectus for the alternative market (simplified);

- Appointment of a listing sponsor for a minimum period of 2 years;

- Placement of offered securities with advised investors through a capital increase of at least

- 1 million dinars or transfer by venture capital funds.

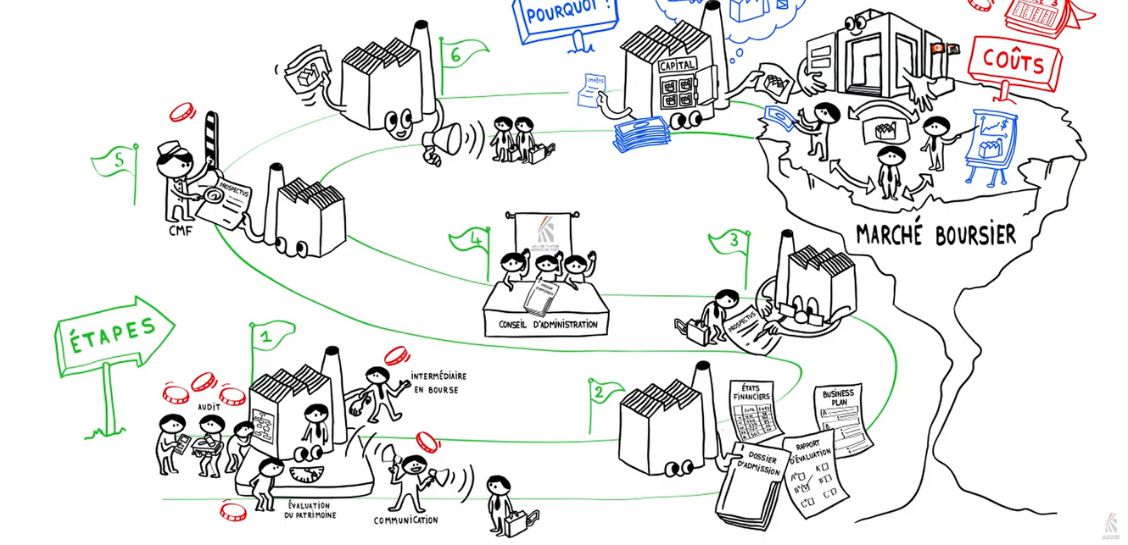

Main Market Listing Process

Phase 1. File Preparation

Decision of the Company’s Board of Directors to launch the IPO process

Selection of partners: (Stockbrokers, Lawyers, Auditors, Communication agencies, etc.)

Preparation with advisors:

- Due diligence reports

- Draft prospectus

Phase 2. File Submission

File submission:

- To the Stock Exchange for admission

- To the CMF for prospectus approval

Review of the file by the Stock Exchange:

- Financial reports

- History/Management

- Strategies, outlook, valuation, etc.

- Obtaining the preliminary approval by the Stock Exchange Board.

- Obtaining the CMF approval of the Prospectus.

Phase 3. IPO Launch

- Roadshow and press presentation

- Financial communication about the transaction

- Management of subscription orders, allocation, closing, etc.

- Notice from the Tunis Stock Exchange

IPO:

- First listing

Often, these steps overlap. A reasonable timeframe to complete an IPO can be estimated at 6 months.

Contact us for more information: Phone or Email

+(216) 71 197 910 |